Navigating China’s financial system as a foreigner can be challenging, especially when it comes to obtaining a credit card.

This guide will help you understand the options, application process, and benefits of credit cards for expats in China.

Why Foreigners Need Credit Cards in China

While debit cards linked to local bank accounts are easy to acquire, credit cards offer unique advantages:

- Building Credit History: Establish financial credibility in China.

- Emergency Backup: Useful for unexpected expenses.

- Rewards and Perks: Many cards offer cashback, travel rewards, and discounts.

- Ease of Travel: Dual-currency cards simplify international transactions.

Eligibility Requirements for Foreigners

To apply for a credit card in China, you’ll typically need:

- Valid Visa and Residency Permit: Work, study, or residence visas are required.

- Local Bank Account: An active Chinese bank account is mandatory.

- Proof of Income: Pay slips, tax receipts, or bank statements are often required.

- Passport: A valid passport for identification.

Some banks may also request additional documents, such as a rental agreement or proof of residency.

Top Credit Card Options for Foreigners

1. China Merchants Bank (CMB)

- Features: Cashback on dining and travel, English-language mobile app, and sign-up bonuses.

- Why Choose CMB: Ideal for expats who value mobile banking convenience.

- Learn More: Visit China Merchants Bank.

2. HSBC China Credit Cards

- Features: Priority pass for airport lounges, global account integration, and travel rewards.

- Why Choose HSBC: Best for expats with international banking ties.

- Learn More: Visit HSBC China.

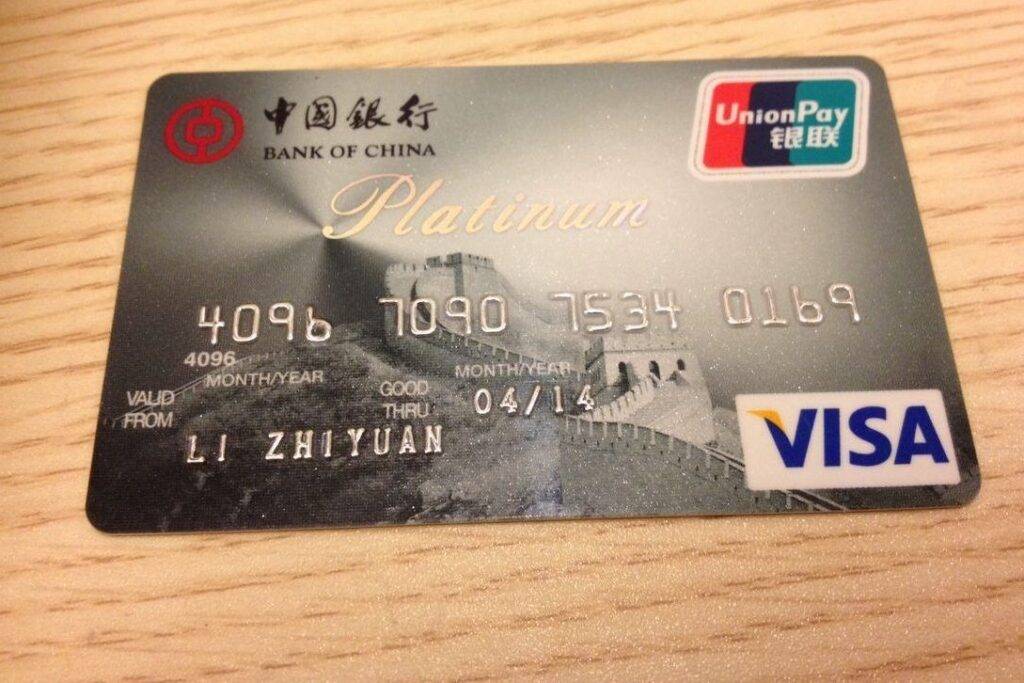

3. Bank of China (BOC) Credit Cards

- Features: Dual-currency support (RMB and USD), rewards programs, and English-speaking customer service.

- Why Choose BOC: A foreigner-friendly option with extensive perks.

- Learn More: Visit Bank of China.

4. ICBC (Industrial and Commercial Bank of China)

- Features: Dual-currency functionality, competitive interest rates, and shopping rewards.

- Why Choose ICBC: Great for frequent shoppers and travelers.

- Learn More: Visit ICBC.

Step-by-Step Guide to Applying for a Credit Card

Step 1: Choose the Right Bank

Evaluate banks based on their benefits, services, and your specific needs.

International banks like HSBC may offer easier processes for expats, while local banks like BOC provide better integration with China’s financial ecosystem.

Step 2: Gather Required Documents

Prepare:

- Passport

- Valid visa or residency permit

- Proof of income (e.g., pay slips or tax receipts)

- Local bank account details

Step 3: Visit the Bank

Most banks require in-person applications for foreigners. Visit the nearest branch of your chosen bank.

Step 4: Complete the Application

Fill out the application form with assistance from bank staff. Ensure all details are accurate.

Step 5: Wait for Approval

Approval typically takes 5–10 business days. Some banks may require additional verification.

Step 6: Activate Your Card

Once approved, activate your card via the bank’s app or customer service hotline.

Tips for Managing Your Credit Card in China

- Track Billing Cycles: Avoid late fees by knowing your payment due dates.

- Monitor Spending: Use mobile banking apps to stay on top of expenses.

- Pay in Full: Avoid interest charges by settling the full balance each month.

- Use Dual-Currency Cards: Minimize international transaction fees.

- Contact Customer Support: Most banks offer English-speaking support for expats.

Common Challenges and Solutions

Challenge 1: Language Barrier

Solution: Opt for international banks or branches with English-speaking staff. Use translation apps like Google Translate for assistance.

Challenge 2: Income Requirements

Solution: Consider secured credit cards, which require a deposit as collateral. Learn more about secured cards at NerdWallet.

Challenge 3: Low Initial Credit Limit

Solution: Demonstrate consistent usage and timely payments to request a limit increase.

Benefits of Credit Cards for Expats

- Emergency Backup: Essential for unexpected expenses.

- Ease of Travel: Dual-currency cards simplify international transactions.

- Rewards and Perks: Cashback, discounts, and travel rewards enhance your financial experience.

By leveraging these benefits, expats can navigate China’s financial system with confidence.

Additional Resources

- XE Currency Converter: Monitor exchange rates.

- Wise (formerly TransferWise): Transfer money internationally at low fees.

- China Banking Regulatory Commission: Stay updated on banking regulations.