Starting a business in China as an expatriate can be a rewarding venture, but it requires navigating a complex legal framework.

This guide outlines the essential steps, licenses, and permits needed to operate legally in China, along with practical tips and resources.

Understanding the Legal Framework for Business in China

China’s business environment is governed by a structured legal system.

Expats must familiarize themselves with key regulations to ensure compliance:

- Company Law of the People’s Republic of China: Governs company registration, management, and governance.

- Foreign Investment Law: Ensures equal treatment for foreign and domestic businesses.

- Administrative Licensing Law: Details the requirements for obtaining business permits.

Key Types of Business Licenses in China

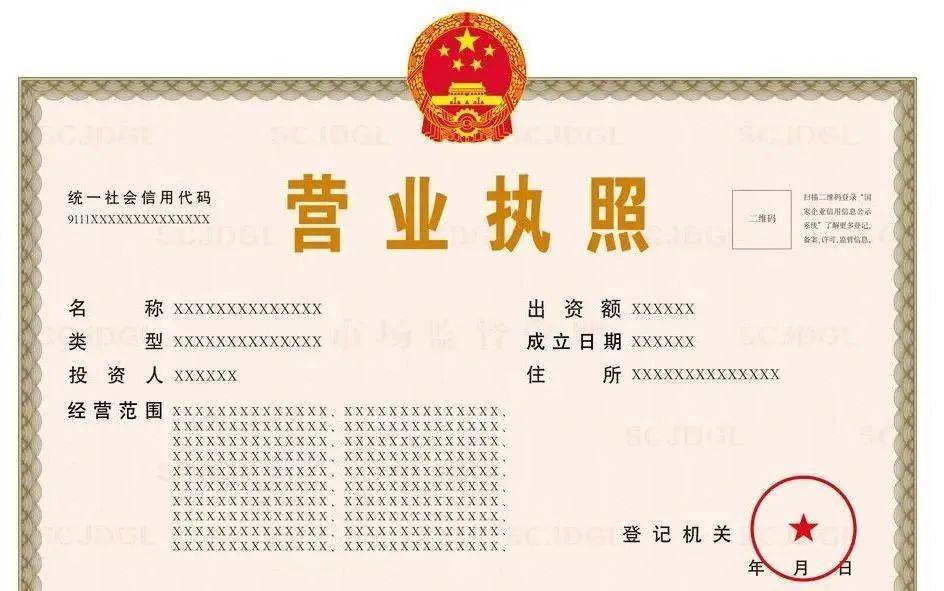

1. Business Registration License (营业执照)

The Business Registration License is the foundation of any legal business in China.

It is issued by the State Administration for Market Regulation (SAMR).

- Requirements:

- Company name approval

- Articles of incorporation

- Legal representative’s identification

- Registered office address

- Processing Time: 2-4 weeks

- Renewal: Annual renewal is mandatory.

2. Foreign-Invested Enterprise (FIE) Approval

Expats establishing a Foreign-Invested Enterprise (FIE), such as a Wholly Foreign-Owned Enterprise (WFOE) or Joint Venture (JV), require additional approvals.

- Steps:

- Submit a feasibility study report.

- Obtain approval from the Ministry of Commerce (MOFCOM).

- Register with the SAMR.

- Documents Needed:

- Business scope

- Foreign investor credentials

3. Industry-Specific Permits

Certain industries require specialized permits. Examples include:

- Food and Beverage: Food Production License, Hygiene License

- Education: Education Operation Permit

- E-Commerce: Internet Content Provider (ICP) License

4. Work Permits and Visas

Expats must secure the appropriate work permits and visas:

- Work Permit: Issued by the Ministry of Human Resources and Social Security.

- Z Visa: Employment visa for China.

- Residence Permit: Required for long-term stays.

Steps to Obtain a Business License in China

Step 1: Company Name Registration

Reserve a company name with the local AMR.

Ensure the name complies with China’s naming conventions and is unique.

Step 2: Submit Documentation

Prepare and submit:

- Articles of Association

- Lease agreement for office space

- Legal representative’s identification

- Shareholders’ details

Step 3: Approval and License Issuance

Once verified, the AMR issues the business license, which includes the company name, registration number, and business scope.

Step 4: Additional Registrations

Register with:

- Tax Bureau: Obtain a tax identification number and register for VAT.

- Social Security Bureau: Mandatory for companies employing staff.

- Customs Authority: Required for import/export businesses.

Common Challenges and Solutions

Language Barrier

Most official documents are in Mandarin. Hiring a bilingual consultant or translator can simplify the process.

Complex Bureaucracy

China’s regulatory procedures can be time-consuming. Engage professional services to handle compliance efficiently.

Changing Regulations

Business laws in China evolve frequently. Stay updated via resources like the China Briefing or consult legal professionals.

Compliance and Renewal of Licenses

- Annual Inspections: Submit annual reports to maintain your business registration.

- Timely Renewals: Renew permits before expiration to avoid penalties.

- Tax Compliance: File taxes accurately and on time.

Real-World Example: Tesla’s Entry into China

Tesla successfully established a wholly foreign-owned enterprise (WFOE) in Shanghai, becoming the first foreign automaker to do so without a local partner. This was made possible by understanding and complying with China’s evolving Foreign Investment Law.

Conclusion

Starting a business in China as an expat requires careful planning and adherence to local laws.

By securing the necessary licenses and permits, you can establish a strong foundation for success in one of the world’s most dynamic markets.

For more information, visit the SAMR Official Website or consult a legal expert specializing in Chinese business law.