Achieving permanent residence in China is a coveted milestone for expats who want long-term integration into one of the world’s most dynamic economies.

One key to a successful application is proving your financial stability. Not only do you need to demonstrate a solid financial history, but you must also present your documents in an organized and professional manner.

In this guide, we outline every step—from gathering essential documents and crafting your cover letter to presenting your portfolio in multiple formats—so you can build a robust case for your China permanent residence application.

Understanding Financial Stability Requirements

Financial stability, in this context, is more than simply having access to funds. It means you have maintained a consistent financial record over several years, ensuring that you can support yourself (and any dependents) without depending on public funds.

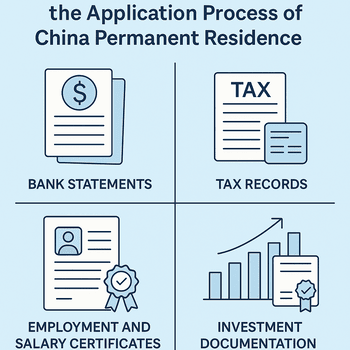

Chinese authorities evaluate your bank statements, tax records, employment or business credentials, and investment documentation to determine your long-term financial well-being.

The National Immigration Administration in China outlines various categories for permanent residence eligibility, such as for investors, skilled professionals, and family-based applicants.

For instance, investors must demonstrate sustained business investments in China, while employment-based applicants can leverage consistent income records from reputable employers.

For more detailed eligibility criteria, see the National Immigration Administration guidelines and the Shanghai Permanent Residence Guidelines.

Essential Documents to Showcase Your Financial Health

A comprehensive financial portfolio is crucial when proving your stability.

Below is a detailed checklist of the documents typically required, along with their purposes and tips for successful presentation:

Document Checklist

| Document | Purpose | Tips |

|---|---|---|

| Bank Statements | Demonstrates consistent cash flow and average balance over the past 2–3 years | Provide original or certified copies and ensure statements show regular income deposits. |

| Tax Records | Confirms responsible tax payments and fiscal discipline | Include certified tax clearance certificates and local tax returns for at least the last three years. |

| Employment & Salary Proof | Verifies steady employment and reliable income records | Attach official employment letters, appointment letters, and recent pay slips. |

| Investment Documentation | Validates your active participation in the local economy through business ventures | Submit business licenses, certificates of investment, and property ownership documents when applicable. |

| Personal Financial Statement | Offers a snapshot of your net worth, including assets and liabilities | Prepare and notarize a detailed statement that includes real estate, stocks, and any outstanding loans. |

| Credit Reports | Demonstrates your responsible credit history | Obtain an updated credit report from a reputable agency to support your financial profile. |

Presenting these documents as a cohesive portfolio not only simplifies the evaluation process but also builds a compelling narrative of your financial security.

Organizing and Presenting Your Financial Portfolio

Your portfolio should tell a clear story. Organizing your documents into clearly labeled sections can work wonders.

Consider using a structured checklist that categorizes your financial history from various angles. Here’s an additional table to help you systematically approach this task:

Financial Portfolio Checklist

| Section | Documents to Include | Why It Matters |

|---|---|---|

| Income & Savings | Bank statements and salary slips | Demonstrates reliable income and consistent savings behavior. |

| Tax Compliance | Tax clearance certificates and local tax returns | Confirms adherence to fiscal responsibilities and regulatory standards. |

| Investments | Investment certificates, business licenses, and property deeds | Validates your active participation in China’s economic growth. |

| Overall Net Worth | Comprehensive personal financial statement (assets vs. liabilities) | Offers a complete picture of your economic stability. |

| Credit History | Recent credit reports | Reinforces your capability in managing financial obligations responsibly. |

Every section adds depth to your application.

Also, remember that if any documents are originally in a non-Chinese language, they require professional Mandarin translations and notarization before submission.

Writing an Accompanying Financial Cover Letter

A well-crafted cover letter can tie your entire financial narrative together.

It adds a personalized touch to your application. Consider including the following parts:

- Introduction:

Introduce yourself, your professional or investment background, and your aspirations for long-term integration in China. - Detailed Explanation of Financial History:

Summarize your financial stability, highlighting steady income, prudent investments, and a responsible tax history. Reference the documents you are submitting. - Connection to China:

Explain how your financial activities—whether investments, professional contributions, or family commitments—align with China’s economic landscape. This connection reinforces your long-term commitment. - Conclusion:

End with a formal note, offering to provide additional information if necessary and expressing your commitment to contributing to China’s vibrant society.

Including such a cover letter helps immigration officers quickly understand the context of your financial documents, easing their review process.

Tailoring Your Approach: Category-Specific Documentation

Different applicant categories have unique requirements.

The following table summarizes the focus areas for investment-based, employment-based, and family-based applicants:

Category-Specific Documentation Requirements

| Applicant Type | Focus Areas | Key Documents |

|---|---|---|

| Investment-Based | Long-term business investments and market consistency | Investment certificates, business licenses, preferred capital verification reports, and bank statements. |

| Employment-Based | Stable career progression, steady salaries, and consistent tax records | Employment letters, salary slips, tax clearance certificates, and employer recommendation letters. |

| Family-Based | Joint financial management and clearly demonstrated family ties | Combined bank statements, shared property documents, and proof of joint tax filings (if applicable). |

Applicants should tailor their documentation to address the expectations of Chinese immigration authorities based on their category.

For instance, an investor will need to highlight long-term performance metrics, while a professional might focus on consistent income and career achievements.

Expert Tips and Best Practices

To further ensure your application is bulletproof, consider these expert tips:

- Document Authenticity:

Always provide original or certified copies. Digital scans might sometimes be acceptable, but certified documents hold more weight. - Consistency is Crucial:

Avoid unexplained large fluctuations in bank statements or sudden financial gaps. Consistency over a period of two to three years builds trust. - Professional Translations:

Have all your non-Mandarin documents professionally translated and notarized. Inaccurate translations can result in misunderstandings or delays. - Consult Experts:

Immigration laws are complex. Engaging legal or financial advisors who have expertise in China’s immigration processes can help review your documents and support your application. - Regular Updates:

If your application process is ongoing, update your documents periodically to ensure they reflect your current financial situation. Timely updates can preclude requests for additional documentation later on.

Following these practices not only strengthens your application but also positions you as a reliable and compliant applicant—a crucial aspect that Chinese immigration authorities value highly.

External Resources and Further Reading

For more detailed requirements and updated procedures, refer to these trusted resources:

| Resource | Description |

|---|---|

| National Immigration Administration | Official guidelines on the entry, exit, and stay of foreigners, including permanent residence criteria. |

| Shanghai Permanent Residence Guidelines | A detailed service guide for foreign investors and other eligible applicants in Shanghai. |

Using these authoritative sources for your application process can provide additional clarity and ensure that you meet local requirements with precision.

Conclusion

Proving financial stability during your China permanent residence application hinges on thorough preparation and meticulous documentation.

By gathering the right documents—from bank statements and tax records to investment certificates and credit reports—you demonstrate a level of fiscal responsibility that meets the expectations of Chinese immigration authorities.

Structured organization is crucial. Use well-formatted checklists and tables to merge your financial documents into a coherent narrative, and back up your application with a personally written cover letter that highlights your commitment to China’s economic society.

No matter your category—whether you are an investor, an employed professional, or joining family—the presentation of your financial portfolio is the linchpin of your permanent residence application.

Maintain authenticity, ensure document consistency, and always have updated translations. These efforts, combined with proactive expert consultation, dramatically improve your chances of a smooth and successful application.

By following these guidelines, you are not only satisfying regulatory requirements but also constructing a compelling financial narrative for your future in China.

Embrace this opportunity as a step toward financial independence and long-term personal growth within a thriving and dynamic society.

Sources & Further Reading

- National Immigration Administration – Guidelines for Foreigners

- Shanghai Permanent Residence for Foreign Investors

For additional insights, consider exploring expert blogs on financial planning for expats, tax compliance in China, and detailed case studies of successful applications.