Last updated: February 7, 2025

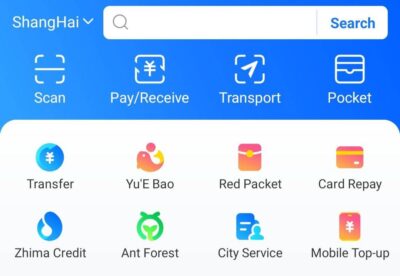

Mobile payments are essential for daily life in China, with Alipay leading the digital wallet revolution.

This guide explores how foreigners can effectively use Alipay, including both its advantages and limitations.

Quick Facts

- Available in 16 languages

- Requires Chinese phone number and bank account/international card

- Works with select international credit cards

- Used by 1.3 billion users globally [Source: Ant Group Annual Report 2024]

Setting Up Alipay as a Foreigner

Requirements:

- Passport

- Chinese phone number

- Bank card (Chinese or supported international)

- Latest version of Alipay (Download from App Store or Google Play)

Step-by-Step Setup:

- Download and install the app

- Select preferred language

- Register with phone number

- Complete identity verification (passport required)

- Link payment method

Key Features and Limitations

What Works Well:

- Multi-language interface

- QR code payments

- Public transport payments

- Food delivery services

- Utility bills payment

- Tourist attractions booking

Common Challenges:

- Limited functionality without Chinese bank account

- Some features restricted for international users

- Occasional translation inconsistencies

- Customer service primarily in Chinese

- International card transaction fees (1-3%)

Payment Options for Foreigners

Short-term Visitors:

- Tour Pass: 90-day validity

- Load up to ¥2,000 per top-up

- International credit cards accepted

- 3% foreign transaction fee applies

Long-term Residents:

- Full account access with Chinese bank account

- Higher transaction limits

- Lower fees

- Access to investment and insurance products

Security Considerations

Protection Measures:

- Biometric authentication

- Real-time fraud detection

- PIN protection

- 24/7 monitoring

Best Practices:

- Enable face/fingerprint verification

- Set strong password

- Monitor transactions regularly

- Enable notifications

Tips for First-Time Users

Do:

- Start with small transactions

- Save emergency contact numbers

- Keep screenshots of important QR codes

- Download offline maps

Avoid:

- Sharing account credentials

- Using public WiFi for transactions

- Keeping large amounts in the wallet

- Ignoring security notifications

Alternatives and Comparisons

WeChat Pay:

- Similar functionality

- Integrated with messaging

- Slightly different setup process

- Compare features

UnionPay:

- Wider international acceptance

- Traditional card-based system

- Less functionality for daily services

Recent Updates (2024-2025)

- Enhanced English customer support

- Improved international card compatibility

- New tourist-friendly features

- Increased transaction limits for foreigners

External Resources

- Official Alipay International Website

- National Financial Regulatory Administration

- Harris Sliwoski’s Guide to Opening a Bank Account in China as a Foreigner

Expert Tips

From Financial Advisors:

- Keep multiple payment methods

- Monitor exchange rates

- Understand transaction limits

- Keep documentation of large transactions

From Experienced Expats:

- Screenshot important payment codes

- Save offline copies of vital QR codes

- Build relationship with local bank

- Learn basic Chinese payment terms

Need Help?

- Alipay International Support: +86-95188

- Email: overseas.support@alipay.com

- WeChat Official Account: AlipayGlobal

Disclaimer: Information accurate as of February 2025. Features and requirements may vary by region and user status. Always verify current terms and conditions with Alipay directly.