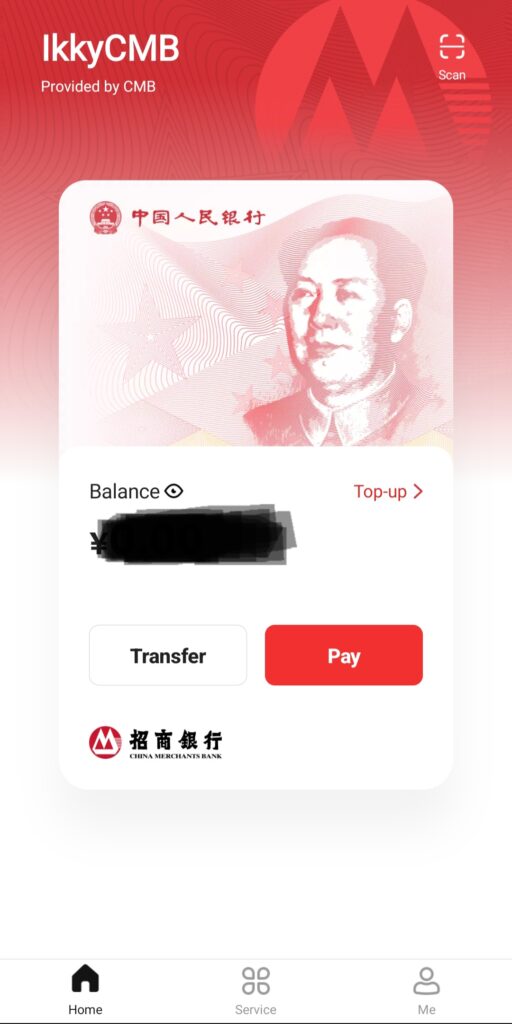

In a remarkable development, the Chinese central bank has unveiled a series of enhancements to its digital yuan application, introducing an array of novel features powered by the Central Bank Digital Currency (CBDC).

This update also includes expanded service offerings and convenient utility bill payment functionalities.

Central People’s Bank of China Introduces Digital Yuan App

The Central People’s Bank of China (PBoC) initially launched its mobile application in early 2022, marking a significant milestone in the country’s digital currency landscape. Since then, the PBoC has continued to push the envelope in digital innovation.

You can download the e-CNY app from:

- Apple Appstore: 数字人民币(试点版)

- Tencent Appstore: https://sj.qq.com/appdetail/cn.gov.pbc.dcep

A Significant Year-End Update

Towards the close of the previous year, the PBoC delivered a substantial update to its digital yuan app, raising the bar for digital currency services. This latest revision brings a host of new capabilities that promise to make citizens’ lives easier and more efficient.

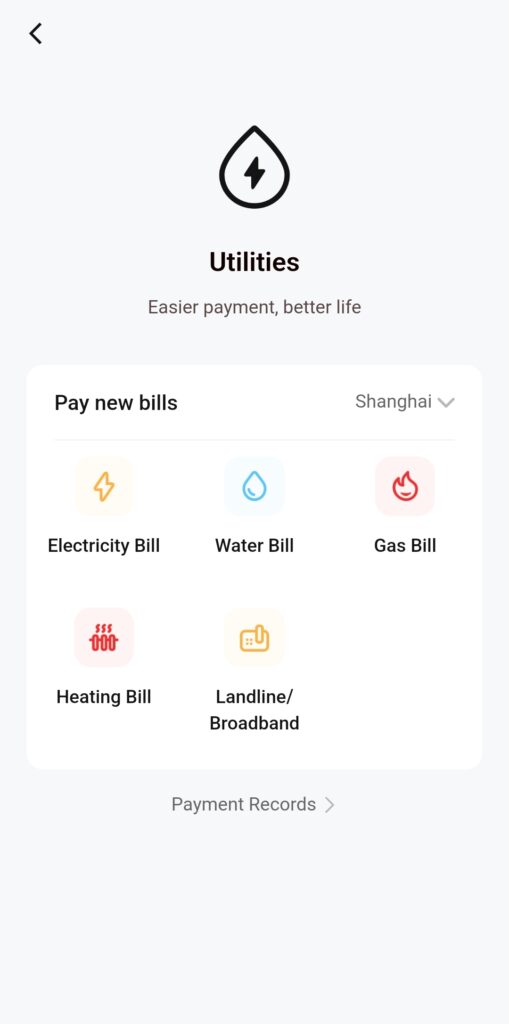

Streamlined Bill Payments

One of the standout features of this update, as reported by Shanghai Securities News, is the ability for residents within the digital yuan pilot zone to settle their essential bills seamlessly. This includes payments for water, electricity, gas, and heating services. Moreover, the digital yuan app now extends its functionality to cover landline phone bills, mobile bills, broadband internet charges, and cable TV subscriptions.

Convenient Mobile Top-Ups

In addition to bill payments, the app now empowers users to conveniently recharge their pay-as-you-go mobile plans, eliminating the hassle of seeking out physical recharge options. This added convenience reflects the PBoC’s commitment to enhancing the overall user experience.

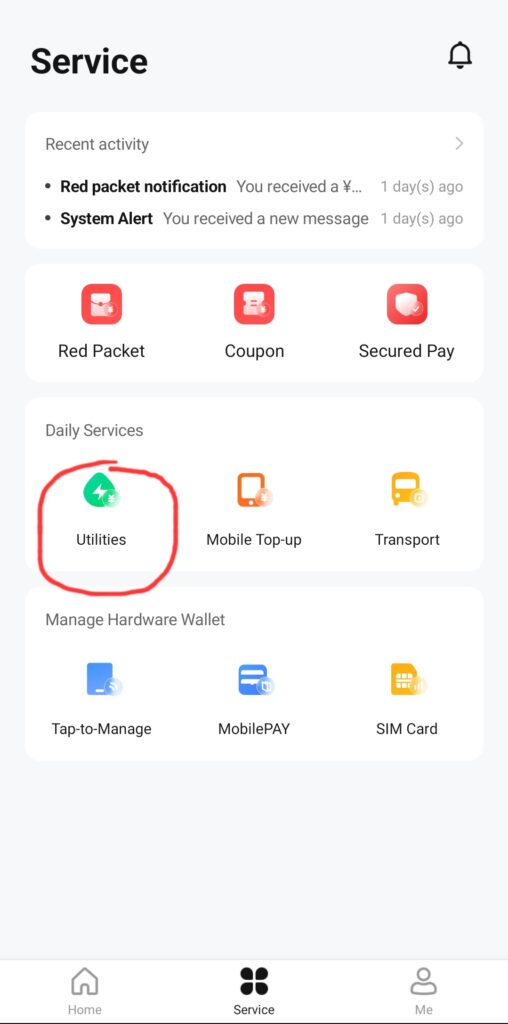

Introducing a Comprehensive “Services” Menu

The latest update introduces a brand-new “services” menu within the app, opening doors to a wide range of possibilities. To deliver these services seamlessly, the central bank has forged partnerships with several state-owned telecom companies, internet service providers, state-run energy providers, and more. These strategic collaborations enable users to make real-time CBDC payments, further driving the adoption of digital yuan.

Expanding Merchant Platforms

Shanghai Securities News also reports that approximately 140 “merchant platforms” are now integrated into the app’s new “Quick Payment Management” menu. These platforms include prominent players in the private sector retail industry, as well as businesses operating in the travel, lifestyle, and tourism sectors. Users within the digital yuan pilot zone can now enjoy two convenient payment options: digital yuan payments directly through merchant websites and apps, and the lightning-fast “quick pay” feature available within the official PBoC app.

Strengthening the Digital Yuan Ecosystem

The rapid progress of the digital yuan is evident from H1 reports of some of the PBoC’s most prominent CBDC partners. These reports highlight the continuous expansion of digital yuan application scenarios in 2023, coupled with a notable increase in the CBDC penetration rate. These partners are laying the foundation for upcoming CBDC pilot phases that promise to further revolutionize the digital currency landscape.

A Glimpse into the Future

According to a recent study by China International Capital Corporation, a “relatively complete digital yuan ecosystem” is expected to be fully established in China by the end of 2025. The same study also anticipates “significant progress” in the PBoC’s CBDC adoption initiatives throughout the remainder of 2023. This projection reaffirms the central bank’s unwavering commitment to innovation and digital transformation.

In conclusion, the recent updates to the Chinese central bank’s digital yuan app represent a significant leap forward in the world of digital currency. With enhanced features, seamless bill payments, and a growing ecosystem of merchant partners, the digital yuan continues to pave the way for a cashless future in China.